Factoring is a financial strategy where businesses sell their accounts receivable to improve cash flow. This guide explores two main types: recourse and non-recourse factoring. Recourse factoring offers lower costs but retains risk for the business, while non-recourse factoring provides more protection at a higher cost. Understanding these options helps businesses make informed decisions to optimize their financial operations.

Introduction

Factoring is a vital financial tool that allows businesses to convert their accounts receivable into immediate working capital. By selling invoices to a third party (factor), companies can improve cash flow, manage credit risk, and focus on core operations. This article delves into the two primary types of factoring: recourse and non-recourse, providing a comprehensive comparison to help businesses choose the best option for their needs.

What is Recourse Factoring?

Recourse factoring is an arrangement where the business retains the risk of non-payment by customers. If a customer fails to pay, the business must buy back the unpaid invoice from the factor.

Key Features of Recourse Factoring:

- Lower Cost: Fees are typically lower due to reduced risk for the factor.

- Higher Advance Rates: Factors often offer a higher percentage of the invoice value upfront.

- Retained Risk: The business remains responsible for customer creditworthiness.

- Credit Control: More control over credit terms and collections process.

Case Study: Recourse Factoring for Manufacturing Company A

Manufacturing Company A chose recourse factoring to manage seasonal cash flow fluctuations. With a history of reliable customers, they factored a $25,000 invoice:

- Advance rate: 90% ($22,500 upfront)

- Factoring fee: 1.5% ($375)

- Reserve: 10% ($2,500) returned upon customer payment

- Total cost: $375 (1.5% of invoice value)

This allowed them to maintain steady production during slow seasons and take on larger orders during peak times, benefiting from lower fees due to their retained risk.

What is Non-Recourse Factoring?

Non-recourse factoring shifts the risk of non-payment from the business to the factor. If a customer doesn’t pay, the factor absorbs the loss.

Key Features of Non-Recourse Factoring:

- Higher Cost: Fees are typically higher due to increased risk for the factor.

- Risk Transfer: The factor assumes the risk of non-payment.

- Credit Protection: Provides a safeguard against bad debt.

- Simplified Accounting: Factored invoices can be removed from balance sheets.

Case Study: Non-Recourse Factoring for Trucking Company B

Trucking Company B opted for non-recourse factoring to protect against the uncertain credit profiles of their clients. They factored a $25,000 invoice:

- Advance rate: 85% ($21,250 upfront)

- Factoring fee: 3% ($750)

- Reserve: 15% ($3,750) returned upon customer payment

- Total cost: $750 (3% of invoice value)

Despite higher fees, this choice allowed them to confidently expand their customer base without worrying about potential losses from unpaid invoices, especially valuable in the volatile trucking industry.

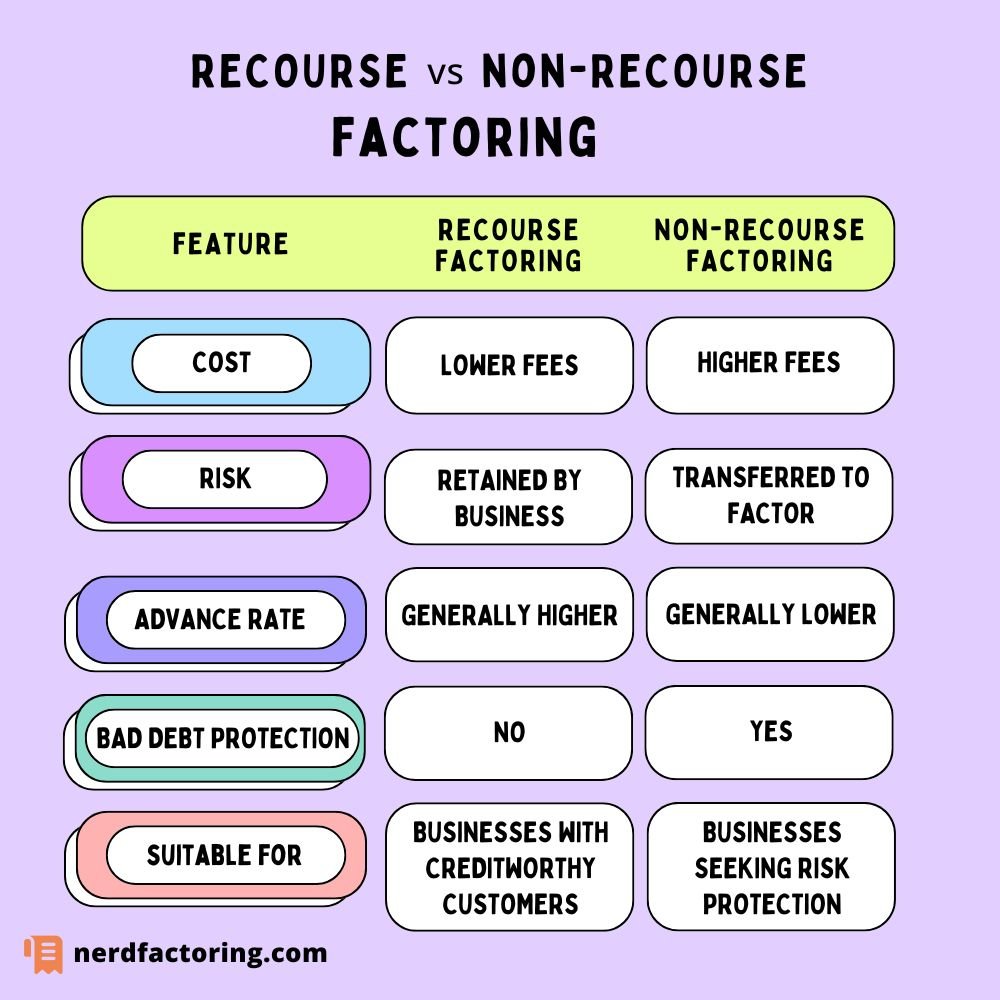

Comparing Recourse and Non-Recourse Factoring

| Feature | Recourse Factoring | Non-Recourse Factoring |

| Cost | Lower fees | Higher fees |

| Risk | Retained by business | Transferred to factor |

| Advance Rate | Generally higher | Generally lower |

| Bad Debt Protection | No | Yes |

| Suitable for | Businesses with creditworthy customers | Businesses seeking risk protection |

Industry-Specific Applications

Different sectors may find one type of factoring more beneficial:

- Trucking: Often prefers non-recourse factoring due to long payment cycles and the volatile nature of the industry. It helps manage cash flow for fuel and maintenance costs.

- Manufacturing: May opt for recourse factoring if they have established customer relationships. It helps fund production cycles and manage inventory.

- Oil & Gas: Frequently uses non-recourse factoring due to high-value invoices and complex payment structures. It aids in managing capital-intensive operations.

- Business Services: Often uses recourse factoring for its lower costs, especially when dealing with reliable corporate clients.

- Staffing: Benefits from both types, with non-recourse preferred for newer or less stable clients. Factoring helps meet payroll obligations.

- Construction: Typically prefers non-recourse due to long payment cycles and project-based work. It helps manage cash flow for materials and labor costs.

- Healthcare: Frequently uses non-recourse factoring due to complex billing and reimbursement processes, especially when dealing with insurance companies.

- Import & Export: Often opts for non-recourse factoring to mitigate risks associated with international transactions and varying payment terms.

- Retail: Seasonal businesses might benefit from recourse factoring’s lower costs during peak periods. It helps manage inventory purchases and staffing needs.

- Government Contractors: May use either type, with non-recourse preferred for newer contracts. Factoring helps bridge gaps in long payment cycles typical of government work.

- Wholesale & Distribution: Often uses recourse factoring for its cost-effectiveness, especially when dealing with established retail clients. It aids in managing large orders and maintaining inventory.

How Factors Assess Risk and Determine Fees

Factors consider several elements when assessing risk and setting fees:

- Customer Creditworthiness: Factors analyze the payment history and financial stability of the business’s customers.

- Invoice Volume: Higher volumes often lead to better rates.

- Industry Risk: Some industries are considered higher risk due to market volatility or regulatory challenges.

- Business Financial Health: The overall financial stability of the business seeking factoring services.

Legal and Regulatory Considerations

Factoring agreements are subject to various laws and regulations, which can vary by jurisdiction. Key considerations include:

- Uniform Commercial Code (UCC): In the US, Article 9 of the UCC governs secured transactions, including factoring.

- Notice of Assignment: Many jurisdictions require formal notice to the debtor when invoices are factored.

- Truth in Lending Act: May apply to some factoring arrangements, requiring specific disclosures.

- International Factoring: Cross-border transactions may involve additional regulations and export/import laws.

Emerging Trends in Factoring

The factoring industry is evolving with technological advancements:

- Blockchain Technology: Enhancing transparency and security in transactions.

- AI and Machine Learning: Improving risk assessment and fraud detection.

- Online Platforms: Streamlining the factoring process and connecting businesses with multiple factors.

- Supply Chain Finance: Integrating factoring with broader supply chain financial solutions.

Choosing a Reputable Factor

When selecting a factoring partner, consider the following:

- Experience: Look for factors with a proven track record in your industry.

- Transparency: Ensure all fees and terms are clearly explained.

- Technology: Choose factors with robust online platforms for easy invoice management.

- Customer Service: Responsive support is crucial for addressing issues quickly.

- Flexibility: Consider factors that offer both recourse and non-recourse options.

Alternative Financing Options

While factoring offers unique benefits, businesses should also consider alternatives:

- Business Lines of Credit: Flexible borrowing for ongoing needs.

- Invoice Financing: Similar to factoring, but invoices are used as collateral for a loan.

- Merchant Cash Advances: Based on future credit card sales, suitable for retail businesses.

- Peer-to-Peer Lending: Online platforms connecting businesses with individual lenders.

FAQ

How quickly can I receive funds through factoring?

Typically, businesses can receive funds within 24-48 hours of invoice submission.

How quickly can I receive funds through factoring?

Typically, businesses can receive funds within 24-48 hours of invoice submission.

Can I factor only some of my invoices?

Yes, most factors allow selective factoring, giving you flexibility in choosing which invoices to factor.

How does factoring affect my relationship with customers?

Professional factors often maintain positive customer relationships, but it’s important to communicate the change in payment instructions clearly.

Is factoring suitable for B2B or B2C businesses?

Factoring is primarily used in B2B transactions due to the nature of invoicing and credit terms.

Can startups benefit from factoring?

Yes, factoring can be particularly helpful for startups needing to manage cash flow without taking on traditional debt.

Conclusion

Choosing between recourse and non-recourse factoring depends on your business’s risk tolerance, customer base, and financial goals. By understanding the nuances of each option and considering your specific industry needs, you can leverage factoring to enhance cash flow, reduce financial risk, and support sustainable growth. As the factoring industry continues to evolve with technological advancements, businesses have more opportunities than ever to find tailored solutions that align with their financial strategies.